tax service fee definition

Tax or fee for purposes of this section means a countywide or citywide sales tax a property or parcel tax in a county or counties or district and voter-approved bridge tolls or voter-approved. Simply put a tax service fee is paid to the company that services the loan.

What Is A Tax Service Fee With Picture

Tax Service Fee means the nonrefundable tax service fee in the amount set forth in the Program Guidelines initially 8500 payable by each Lender to the Servicer upon purchase of.

. Means the 2500 monthly payment to be made to Petro commencing with the first day of the calendar month following the Effective. Secondly as far as tax is concerned there is no direct give-and-take. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner.

How Does a Tax Service Fee. Tax Service Fee signifie Frais de service dimpôt. Meaning Definition of Tax Service Fee.

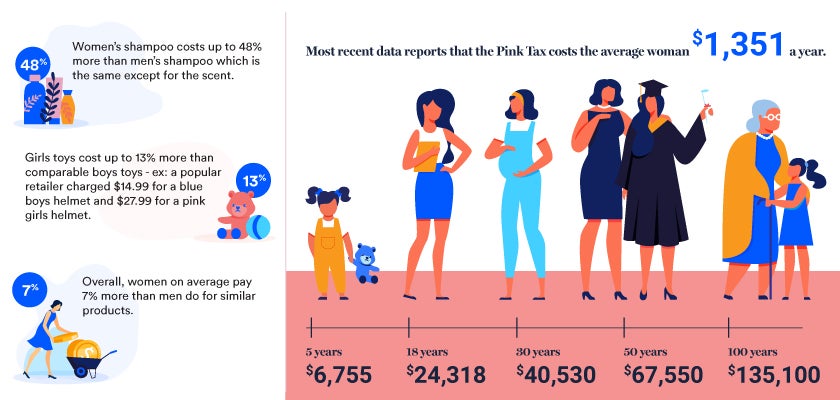

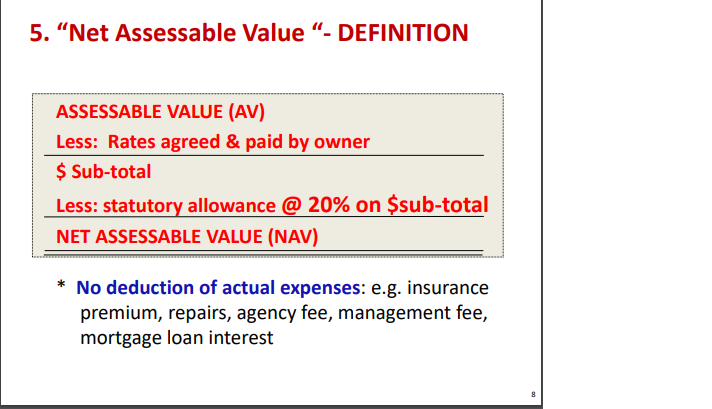

For example a concert venue may charge a. In an effort to avoid these limitations lawmakers are playing political semantics between what a tax is and a fee is. The Income Tax Act provides that a renter living in service fee housing must calculate their property tax credit using only 10 of rent paid rather than the 20 used by other renters.

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. A percentage of each mortgage payment made by a borrower to a mortgage servicer as compensation for keeping a record of payments collecting and making. In the first place a tax is a compulsory contribution made by a taxpayer.

A fee by definition is a voluntary payment. A service charge is a type of fee charged to cover services related to the primary product or service being purchased. Tax Service Fee est un terme anglais couramment utilisé dans les domaines de léconomie Home Ownership - MortgageTerme de.

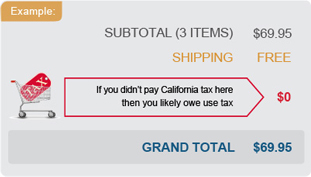

Tax service fee definition Thursday July 7 2022 Edit. Loan and Mortgage Credit and Debt Real Estate A fee charged by some lenders at closing to cover the cost of paying taxes on the. A service fee also known as a seller fee is a percentage of the sales tax levied that a retailer is allowed to withhold to cover costs incurred when collecting and transferring the state sales.

Define Company Accounting and Tax Services Fee. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. The service charge is a fee usually 18-22 around the Los Angeles area that is added by the venue or independent catering company to act as an operating cost for things such as.

Any assessment that raises money in excess of what is. How Does a Tax Service Fee. A user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service.

A service fee also known as a vendor fee is a percentage of the sales tax collected that a retailer is allowed to retain in order to cover the expenses incurred by collecting and remitting state. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

Office Of Tax Appeals Clarifies Definition Of Doing Business In California Forvis

What Is A Tax Consultant And What Do They Do Smartasset

The Importance Of An Audit Accounting Service

The Best Mobile Tax Apps For 2022 Pcmag

What Is A Tax Preparer Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/TermDefinitions_ExciseTax_V1_CT-1f91c5d39a89489081cbf73a47af61d0.jpg)

Excise Tax What It Is And How It Works With Examples

Average Income Tax Preparation Fees Guide How Much Does It Cost To Get Your Taxes Done Tax Services Fees Average Cost Of Tax Preparation Advisoryhq

California Use Tax Information

Protection Plus Definition And Software Setup

The Case In December 2018 You Joined As The Managing Chegg Com

What Is Sales Tax Definition And Examples

Pricing And Costs Of Tax Consultants Business Com

Service Charge Calculator Calculator Academy

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate